The need for fast and secure international money transfer apps has never been greater; Whether it’s for supporting family members, conducting business transactions, or simply managing financial affairs across borders, the ability to move money seamlessly from one country to another is a vital aspect of modern life.

If you’re in Canada and have loved ones or financial interests in Nigeria, you’ll likely find yourself searching for reliable and convenient apps to transfer money from Canada to Nigeria.

I understand the difficulties that can surface when sending funds overseas, such as increasing exchange rates, outrageous fees, and tiresome processes. And that is why this article was created – to assist you in navigating the world of international money transfers and transferring money across the ocean.

To help you make informed decisions and streamline your money transfer experience, I’ve curated a list of the top 5 money transfer apps designed specifically to help transfer money from Canada to Nigeria swiftly.

Whether you’re an expatriate sending financial support to your family back home, a business owner making international payments, or an individual looking for the best way to handle cross-border transactions, these apps offer a range of solutions to suit your needs.

Without further ado, join us as we explore the top 5 money transfer apps that will simplify and expedite your money transfers from Canada to Nigeria, take a good look at the advantages of using money transfer apps, and discuss the key factors to consider when choosing a money transfer app.

Recommended >>> 20+ Low Money Business Ideas: Check out our List!

Best Apps to Transfer Money From Canada to Nigeria

Here are the best money transfer apps to transfer money from Canada to Nigeria;

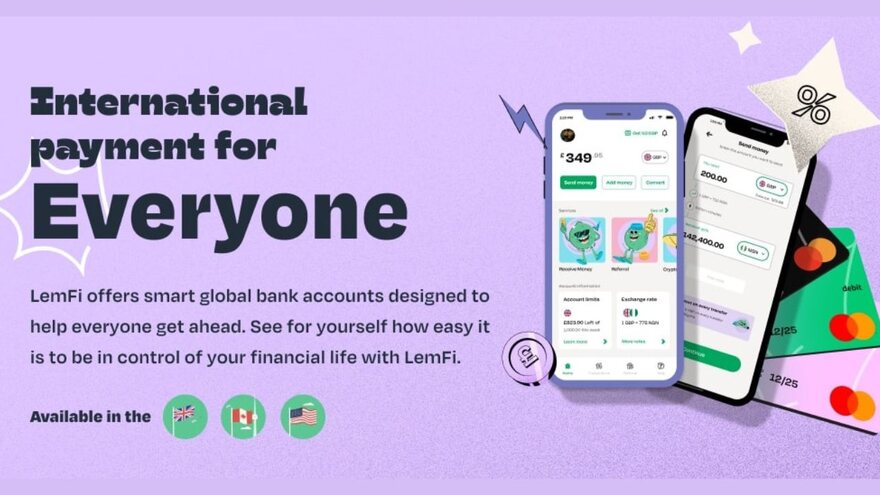

1. LemFi (Formerly Lemonade Finance)

The first money transfer app on our list is LemFi. Formerly known as Lemonade Finance, LemFi is a financial technology company with a mission to help immigrants have stress-free financial transactions.

Established in 2020, LemFi operates as an Electronic Money Institution licensed by the Financial Conduct Authority in the United Kingdom under the name RightCard Payment Services. Additionally, it is registered as a Money Service Business with the Financial Transactions and Report Analysis Centre in Canada.

LemFi offers a user-friendly mobile application that serves as a gateway to a world of financial services. With LemFi, users gain access to a suite of features, including payment services, global accounts, and international money transfers.

This platform allows immigrants to seamlessly send money to over 20 countries, all while maintaining the highest standards of regulatory compliance.

Key Features

These are the key features that LemFi offers;

- Global accounts: With LemFi, you can open a US Dollar, Nigerian Naira, Canadian Dollar, or United Kingdom Pounds account in less than 5 minutes.

- International money transfer: You can send and receive money from over 20 different countries instantly for free.

- Currency conversion: LemFi also allows you to convert money from one currency to another for free. No wait time and no hidden fees!

- Receive or request money: You can also send and request money, and share a payment link for your friends and even customers to pay via bank transfers, card, or even mobile money on the LemFi app.

Download LemFi (Android – iPhone)

2. WorldRemit

WorldRemit is an international money transfer app that has revolutionized international money transfers for over a decade. Founded in 2010 by Ismail Ahmed, Catherine Wines, and Richard Igoe, WorldRemit operates in over 130 countries and supports over 70 currencies.

This cutting-edge platform specializes in facilitating cross-border money transfers from over 50 countries to destinations all over the world. WorldRemit provides a diverse range of payout options, such as bank deposits, mobile money, mobile airtime top-ups, cash pick-ups, and even cash delivery services.

WorldRemit has built connections with numerous mobile money systems around the world, including Zaad (Somaliland), M-Pesa (Kenya), MTN (across Africa and Asia), and bKash (Bangladesh). WorldRemit’s coverage had grown to 115 countries as of October 2019.

Key Features

- Global Reach: WorldRemit operates in over 130 countries and supports more than 70 currencies, making it one of the most extensive international money transfer services.

- Versatile Payout Options: Recipients have multiple payout options, including bank deposits, mobile money, mobile airtime top-ups, cash pick-up, and even cash delivery, providing flexibility and convenience.

- Extensive Corridor Network: With a network of over 5,000 corridors, WorldRemit ensures that users can send money to a wide range of destinations globally, including remote areas.

- Mobile Money Integration: WorldRemit is connected to various mobile money services worldwide, making it particularly useful for users in regions where mobile money is a common form of financial transactions.

- African Coverage: WorldRemit’s extensive coverage includes all African countries except for a few exceptions, offering a robust solution for those sending money to and from the African continent.

- Acquisitions and Growth: The acquisition of Sendwave and the impressive transaction numbers from 2020 highlight WorldRemit’s commitment to expanding its presence in the cross-border digital payments market.

- User-Friendly Interface: WorldRemit’s mobile app provides a user-friendly interface that simplifies the process of sending money internationally, making it accessible to a wide range of users.

- Secure Transactions: WorldRemit places a strong emphasis on the security of transactions, ensuring that users can transfer money with confidence and peace of mind.

- Competitive Exchange Rates: The platform offers competitive exchange rates, allowing users to maximize the value of their money when sending funds abroad.

Download WorldRemit (Android – iPhone)

3. Simplii Financial

The next money transfer app on our list is the Simplii Financial Global Money Transfer app. Simplii Financial, the digital banking division of the Canadian Imperial Bank of Commerce (CIBC), is a major Canadian direct bank serving approximately two million clients as of September 2023.

Simplii Financial is noted for its dedication to consumer convenience and innovation while providing a wide range of financial products. The app can be used to transfer money from Canada to Nigeria, as well as over 20 other countries.

The bank also offers investing options such as Guaranteed investing Certificates (GICs), Registered Retirement Savings Plans (RRSPs), Tax-Free Savings Accounts (TFSAs), and mutual funds.

Simplii Financial, in particular, has pioneered digital identity verification in Canadian banking, allowing immigrants and newcomers to open accounts digitally prior to arrival.

Key Features

- Global Money Transfers: Simplii Financial also facilitates global money transfers, providing customers with a convenient solution for international fund transfers.

- No-Fee Banking: Simplii Financial provides customers with access to no-fee checking and high-interest savings accounts, ensuring that essential banking services come without monthly fees.

- Credit Card Services: The Simplii Financial Cash Back Visa Card offers customers a convenient and rewarding credit card option, with the potential to earn cashback on their purchases.

- Mortgages: Simplii Financial offers both variable and fixed residential mortgages, catering to customers looking to finance their homes or refinance their existing mortgages.

- Lines of Credit: The bank provides various credit options, including personal loans, secured lines of credit, and creditor insurance, assisting customers in managing their financial needs.

- Investment Opportunities: Customers can explore investment products such as Guaranteed Investment Certificates (GICs), Registered Retirement Savings Plans (RRSPs), Tax-Free Savings Accounts (TFSAs), and mutual funds to grow their wealth and save for the future.

- Digital Banking Convenience: Simplii Financial offers robust digital banking services, allowing customers to perform transactions, access account information, and utilize e-transfers seamlessly through online and mobile platforms.

- Visa Digital Gift Card: The Simplii Financial Visa Digital Gift Card is a versatile option for sending and receiving gift funds electronically.

Download Simplii Financial (Android – iPhone)

4. Remitly

Remitly is a leading American internet money transfer app that was founded in 2011. Headquartered in Seattle, Washington, the app has a strong presence in over 150 countries and facilitates worldwide money transfers, making it a viable alternative for international transfers.

Remitly recently went public on the Nasdaq exchange in September 2021, highlighting its growth and prominence in the financial industry. Operating exclusively online, Remitly facilitates transfers in around 75 currencies to recipients in 115 different countries, offering convenience and accessibility.

Remitly is a trusted option for safe and fast international money transfers, offering a variety of recipient options such as mobile money services and cash pickup.

Key Features

- Global Reach: Remitly’s extensive network allows users to send money to more than 150 countries, making it a versatile solution for international remittances.

- Nasdaq Listing: In a significant milestone, Remitly became publicly traded on the Nasdaq exchange in September 2021, underlining its growth and prominence in the financial industry.

- Currency and Country Coverage: As of September 2023, Remitly facilitated transfers in over 75 currencies, making it accessible to users with diverse currency needs. Recipients can be located in 115 different countries.

- Digital Operation: Remitly operates entirely online, eliminating the need for physical premises. This electronic approach enhances convenience and efficiency for users.

- Recipient Options: Recipients in many countries can receive funds through various channels, including mobile money services and cash pickup at bank and postal office branches, providing flexibility for the beneficiaries.

5. Paysend

The last app on our list of international money transfer apps that you can use to transfer money from Canada to Nigeria is Paysend. Being a trusted online money transfer specialist, Paysend offers seamless international transfers to over 170 countries worldwide.

To ensure compliance with US-based KYC (know your customer) and AML (anti-money laundering) regulations, Paysend maintains rigorous protocols. Additionally, as a licensed money transfer company in the UK, registered with the FCA (Financial Conduct Authority), Paysend prioritizes security and trustworthiness.

Paysend employs bank-level security, 24/7 customer support, and two-factor authentication (2FA) to safeguard your finances. You can fund your transfers via credit card, debit card (Mastercard or Visa), or bank account, with no extra charges from Paysend based on your payment method.

Handling over US$3.2 billion in cross-border transactions for approximately 3.7 million customers annually, Paysend stands as a reliable choice for hassle-free international money transfers.

Key Features

- Global Reach: Paysend allows users to transfer money to more than 170 countries worldwide, providing broad and comprehensive coverage for international money transfers.

- Transparent Fees and Exchange Rates: Paysend offers straightforward fees and exchange rates, ensuring that users have a clear understanding of the costs associated with their transfers, especially when sending money from the US.

- Regulatory Compliance: Paysend complies with US-based KYC (know your customer) and AML (anti-money laundering) protocols, prioritizing security and regulatory adherence to protect users’ financial transactions.

- UK Licensing: As a licensed money transfer company in the UK, registered with the FCA (Financial Conduct Authority), Paysend maintains a high level of trustworthiness and accountability in its operations.

- Bank-Level Security: Paysend employs bank-level security measures, ensuring that all money transfers are conducted with the same level of security as traditional banking institutions.

- 24/7 Customer Service: Users have access to round-the-clock customer support, providing assistance and resolving issues at any time, enhancing the customer experience.

- Two-Factor Authentication (2FA): Paysend enhances account security with 2FA, an extra layer of protection that prevents unauthorized access to user accounts without possession of the linked phone number.

- Multiple Payment Options: Paysend offers flexibility by allowing users to fund transfers using various methods, including credit cards, debit cards (Mastercard or Visa), and bank accounts, catering to individual preferences.

Download the Paysend app (Android – iPhone)

Advantages of Using Money Transfer Apps

Using money transfer apps offers several advantages, making them a convenient and efficient way to send money internationally or domestically. Here are some key advantages of using money transfer apps:

- Speed: Money transfer apps typically offer faster transfer times compared to traditional banking methods. Many transactions can be completed within minutes to a few hours, making them ideal for urgent financial needs.

- Convenience: Money transfer apps are easy to use, with intuitive interfaces that allow users to initiate transfers from their smartphones or computers, eliminating the need to visit a physical bank or transfer agent.

- Accessibility: These apps are accessible 24/7, allowing users to send money at any time, including weekends and holidays, providing flexibility and convenience.

- Cost-Effective: Money transfer apps often have lower fees and offer competitive exchange rates, reducing the overall cost of sending money, especially for international transfers.

- Transparency: Users can easily track their transactions, view exchange rates, and check the fees associated with each transfer, ensuring transparency in the process.

- Security: Reputable money transfer apps prioritize the security of user data and transactions. They use encryption and adhere to regulatory standards to protect users from fraud and unauthorized access.

- Wide Geographic Coverage: Many money transfer apps have extensive networks, enabling users to send money to a wide range of countries and regions, including remote areas.

- Multiple Payout Options: Recipients can often choose how they want to receive the funds, whether through bank deposits, mobile money, cash pickup, or other convenient methods.

Key Factors To Consider When Choosing a Money Transfer App

When selecting a money transfer app, it’s essential to consider several key factors to ensure that you choose the most suitable option for your needs. Here are the key factors to keep in mind:

Transfer Speed: Evaluate how quickly the app can send funds to your desired destination. Some transactions may be instant, while others can take several business days.

Exchange Rates and Fees: Compare the app’s exchange rates and fees with other providers to ensure you’re getting a competitive deal. Transparent pricing is crucial.

Geographic Coverage: Check if the app covers the countries or regions you need to send money to. Ensure it offers a wide enough network to meet your specific requirements.

Transfer Methods: Determine the various ways you can send money through the app, such as bank transfers, debit or credit cards, or other funding sources.

Security and Compliance: Verify that the app complies with necessary regulations and employs robust security measures, such as encryption and two-factor authentication (2FA).

Customer Support: Research the availability and responsiveness of customer support channels, as timely assistance can be crucial in case of issues or questions.

Trustworthiness and Reputation: Look for reviews and ratings from other users to gauge the app’s trustworthiness and reliability. Consider its history and reputation in the industry.

Transfer Limits: Check if the app has minimum or maximum transfer limits that suit your financial needs.

Availability of Currencies: Ensure the app supports the currencies you intend to send or receive, especially if you frequently deal with less common or exotic currencies.

FAQs

What is the best app to Transfer money from Canada to Nigeria?

The best app used to transfer money from Canada to Nigeria depends on your preferences however, our pick for the best app to transfer money from Canada to Nigeria is WorldRemit.

WorldRemit allows you to transfer money within a few seconds, without any fees. The app is straightforward and for over a decade since its inception, there hasn’t been any case of glitching or any fraudulent activities.

What is the easiest way to send money from Canada to Nigeria?

The best way to send money from Canada to Nigeria is to use an international money transfer app. If you’re looking for the best combination of price, speed, and reliability we recommend using WorldRemit when sending CAD – NGN.

Can I receive money from Canada to my Nigeria account?

Yes, and the fastest way to receive money from Canada to your Nigeria account is by using WorldRemit. They currently offer the fastest transfer speeds for CAD – NGN transfers.

What app can Canada use to send money?

There are several apps that Canadians can use to send money over the globe. These apps include;

- WorldRemit

- Simplii Financial

- Paysend

- Remitly

Read Also >>> Top 5 best Country to Migrate to from Nigeria

Conclusion

Choosing the right app can be pivotal in ensuring the efficiency, security, and cost-effectiveness of your transactions.

In our exploration of the top 5 apps to transfer money from Canada to Nigeria, we’ve provided a comprehensive guide to aid your decision-making process.

Each of these apps, from the innovative LemFi (formerly Lemonade) to the widely accessible Paysend and the extensive reach of WorldRemit, offers unique advantages to cater to diverse needs. Simplii Financial and Remitly also bring their strengths to the table.

As you embark on your financial journey, consider these apps as your trusted companions, simplifying the way you send money across borders.